With the QuickBooks applications, it has become much more convenient for organizations to process the W-2 and W-3 forms accurately and on time. The Employers must have a W-2s form, which contains all the details associated with your total annual wages and the amount withheld from your paycheck. On the other hand, Form W-3 is mainly accessed by employers to report employee income, which is paid to both the IRS and Social Security Administration. Furthermore, you may also print W-2 and W-3 forms in QuickBooks to send the copies to the employees for keeping as a record. In this illustrative post, we have provided in-depth knowledge for printing these forms accurately.

Wondering how to print W-2 and W-3 forms in QuickBooks and need immediate assistance? Contact to our QB experts immediately by dialling the contact number +1-866-408-0444 and let the experts help you in addressing the issue.

Learn the Procedure to Print Your W-2 and W-3 Forms in QuickBooks

The users mainly requires to print the W-2 forms for sending the paper copies to the employees and W-3 form is printed to send it to your accountant. However, you may also send an invitation to the employees to access QuickBooks Workforce and then they can view as well as print the W-2 copies of the current and up to last two years. Furthermore, read the procedure described below for the seamless printing of the forms.

First Step: Get Ready To Purchase the W-2 Paper For Printing

Note: For instance, if your employees have lost or don’t have the original copy of the W-2 form, or you want to have the copy of its records then you can use the plain paper for printing.

On the other end, you must require a W-2 paper when you wish to print via QuickBooks and mail the official copies to the employees.

- In the beginning, for purchasing the W-2 paper, move to the QuickBooks Checks & Supplies site.

- After visiting the site, move to the Tax Products and then click the Blank W-2 kits.

- Furthermore, you must access the guidelines displayed on the screen to complete the order.

- If you are working on the QuickBooks Online Payroll or QuickBooks Desktop Payroll Enhanced, you must buy the 3 or 4-part perforated paper.

- Otherwise, you can access the 4-part perforated paper on getting the QuickBooks Desktop Payroll Assisted.

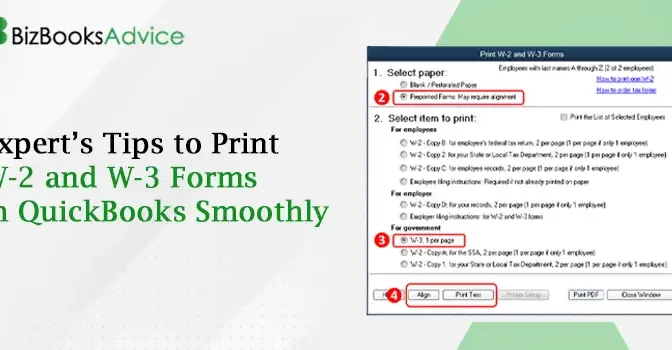

Second Step: Initiate the Printing of Your W-2 and W-3 Forms in QuickBooks Desktop

Once you have make the appropriate choice of the QuickBooks product to begin printing the W-2 and W-3 forms.

QuickBooks Online Payroll

For printing the current year’s or 1 year previous tax forms

- In the first place, the users must switch to the Taxes tab and then click Payroll Tax tab.

- Afterwards, browse to the Filings tab and then hit the Resources, followed by the W-2s forms.

- You are supposed to review the list of employees who picked up the printed copy.

- Thereon, if you spot that your automated taxes and forms settings are disabled, then go through your Form W-2 print settings closely. Later on, opt for the Change Setting option to modify the paper type according to your preference.

- Now, what you need to do is simply tap on the View or Manage on the copy you required.

- W-3 Summary Transmittal of Wage and Tax Statements

- W-2, Copies B, C & 2 (employee)

- W-2, Copies A & D (employer)

- When you are done with the above steps, hit the View and Print option.

- At last, the users are required to pick the Print Icon on the Adobe Reader toolbar and then hit the Print tab.

Steps For Printing The Previous Years Forms

- In the initial stage, choose the Taxes or the Payroll tax and then go ahead with the Filings tab.

- When you are done with the above steps, navigate to the Resources tab, followed by the Archived Forms and Filings tab.

- Afterwards, choose the date range up to which you need to print the forms. Otherwise, you can directly pick up the forms you required manually.

- Soon after this, you must click on the View tab on the W-2 or W-3 form that you require to print.

- At last, the users must opt for the Print icon on the Reader toolbar and click the Print again.

QuickBooks Desktop Payroll Assisted

The users are required to print their W-2 form starting from January 10.

Note: You only need to print the Form if your employee has lost or hasn’t received their original W-2s form.

- Begin the process by choosing the Employees tab and from there click the Payroll Center followed by the File Forms tab.

- Afterwards, you are supposed to click on the View/ Print Forms & W-2s form.

- You are required to insert the correct payroll PIN in the respective text field and hit the OK tab to proceed.

- Furthermore, click the W-2s tab and pick the year along with all or individual employees as per your requirement.

- In the next step, hit the Open/Save Selected tab and then choose the accurate reason for printing the W-2 forms.

- At last, when you are done with the printing process, hit the File tab on the Adobe Reader and tap on the Print option.

QuickBooks Desktop Payroll Enhanced and Standard

- Before moving on with the process try updating QuickBooks to the latest version and then update the payroll tax table.

- After doing this, navigate to the Employees drop-down menu, click the Payroll Tax Forms and W-2s followed by the Process Payroll forms option.

- Now, you must go to the File Forms tab and scroll down to the bottom of the page to pick the Annual Form W-2/W-3 Wage and Tax Statement/Transmittal option.

- When you are done making changes, click the Review/Edit tab to check every W-2 forms. Later on, you must review the W-2 forms and make sure that the checkbox in the Reviewed column is marked.

Learn More About How to File Your W-2 and W-3 forms in QuickBooks

In this blog section, we have described how to file your W-2 and W-3 forms in QuickBooks Desktop in different versions.

QuickBooks Online Payroll

Go through the procedure listed below for the successful filing of the forms in QuickBooks Online Payroll.

First Step: Began E-Filing of Your W-2s Form

- In the first place, you must login to the QuickBooks Online account and move to the Taxes option followed by the Payroll Tax.

- Afterwards, you must opt for the Filings tab and go ahead with the File tab to proceed further.

- Thereon, the users are required to pick the Annual Forms tab > W-2 copies A & D tab.

- When the changes are done, hit the Continue tab and were asked whether one or multiple employees were active participants in retirement.

- Now, browse to the Employer Copies: Form W-2 page and then choose the View tab to bring up the Adobe Acrobat application.

- Now, you must closely analyse and then print the copy D which is employer’s copy for the record purpose.

- At last, go ahead with the Submit to authorize us to file Copy A of the Form-2 electronically.

After you successfully processed your W-2 filings, you will instantly obtain an email informing you that your filing is completed. Despite this, you may also verify the exact status of your filings on the status page.

- To check the filing status, navigate to the Taxes option followed by the Payroll Tax option.

- After this, you must opt for the Payroll forms or filings option and then the W-2s form.

Second Step: Start Printing Your W-2s Forms and Send Them to Your Employees

QuickBooks Online Payroll

Before printing the W-2 forms in QuickBooks, you can view them and then print the forms to send them to your employees.

View Your Forms in the QuickBooks WorkForce App

- In the first place, choose the Money option and then hit the View Details tab to view the current pay stub.

- After doing this, you must opt for the Download tab, and to view other pay stubs, go ahead with the View option.

- At last, the users are supposed to pick those paystubs that they want to print.

However, if you choose to mail your W-2s form to your employees, then they will provide you with the mail mentioned in the employees profile.

QuickBooks Desktop Payroll Assisted

The QuickBooks will file the W-2s form for you on its own. Alternatively, you may also choose to print copies of your employees on your own once it is prepared.

QuickBooks Desktop Payroll Enhanced

Step 1: Began Setting Up of the W-2s E-Filing Process

For e-filing of the W-2s forms, you must carry on with the process discussed below.

- In the beginning, launch the QuickBooks application and move to the Employees tab.

- After this, from the drop-down menu list choose the Payroll Center and then launch the QuickBooks Desktop Payroll Setup.

- You are supposed to click on the File Forms tab and from the Other Activities list, go ahead with the Change Filing method.

- When you are all set, tap on Continue tab > Federal Form W-2/W-3 from the list of forms and hit the Edit tab.

- Soon after this, click the E-file and then choose the Finish tab. With this, it will instantly launch the enrolment instructions that you can read or print.

- Furthermore, you must exit from the View Enrolments window and then click the Finish Later.

Step 2: Establish Your W-2 Forms Manually

- Under this process, you must opt for the Employees tab and then click the Payroll Tax Forms and W-2s.

- After that, you need to pick the Process Payroll Forms tab to carry on with your ongoing process.

- Now, reach to the File Forms section, pick the Annual Form W-2/W-3 (Wage and Tax Statement/ Transmittal) option and then hit the Create Form tab.

Step 3: Get Ready to Send Your W-2s Forms

- Once you are all set to send the forms, browse to the Process W-2s tab and then pick the All Employees tab.

- Now, start accessing the Select Filing Period section and include the year of the form you wish to file.

- Go to the Select Employee for Form W-2/W-3 and pick the employees. Alternatively, you may also opt for the Mark All option to see all of the employees.

- After doing this, choose the E-File Federal Forms tab and insert your business phone number and email address.

- Once you are done including the necessary details, hit the Submit tab.

Step 4: Began Printing Your W-2 forms and Send Them To Your Employees

You can now print the W-2s and W-3s forms in QuickBooks using the procedure explained above.

QuickBooks Desktop Payroll Standard, QuickBooks Desktop Payroll Basic Users

The employers have to file the Federal as well as state W-2s and W-3 forms manually by the end of Jan 31st.

What’s the Right Time For Filing the W-3 Forms in QuickBooks?

The filing of the W-3s forms entirely depends upon how you have filed the W-3s forms with the Social Security Administration (SSA).

- For instance, if you have mail the W-2 A copy to the SSA, then it is mandatory to file the Form W-3 form along with the W-2 copy A.

- Moreover, it isn’t compulsory to file form W-3 if QuickBooks files W-2s for you or you have filed them electronically via your payroll services.

Summarizing the Above!!

So, here comes the end of this post and hope that the steps listed above will help you to print W-2 and W-3 forms in QuickBooks Desktop. However, if you are still looking for any professionals help, then you can communicate with our QB experts at +1-866-408-0444 for better results.