Accounting

Accounting

QuickBooks Payroll is one great feature that lets employers pay their employees on time without causing any further delays. But, most often, it is experienced that the users might discover that QuickBooks Payroll check transactions not matching because the amount mentioned in charts of accounts vary from the amount mentioned in payroll settings. Unfortunately, this issue prevents the users from creating paychecks, leading to delays in paying employees on time.

In this write-up, we have elaborated on all the possible factors that might cause payroll check transactions to not match in QuickBooks and mentioned simplified methods to address the issue smoothly.

QuickBooks Payroll Check Transaction Not Matching and is creating issues while processing the employee’s paycheck? Here comes a time when you must contact our QB professionals at +1-866-408-0444, and they will assist you in the best possible manner.

Reasons Why Payroll Check Transactions Not Matching in QuickBooks

Thinking why payroll check transactions not matching in QuickBooks and want to gather information regarding what causes this issue. If that’s so, then you have reached the right spot. After a deep investigation, we have landed on the following root causes that will shed some light on the occurrence of the error. Let’s check them out and find the right direction.

- You might discover this error when the Bank Account Name in the charts of accounts is different from the one listed in the QuickBooks Payroll Settings.

- Another factor that might cause this issue is that you are working on an obsolete version of QuickBooks Desktop.

- The issue may arise in certain instances when the transaction type listed in QuickBooks varies from the one mentioned in your bank.

- You might have entered the wrong check number, which is creating problems when clearing the cheque.

- Sometimes, the check transactions in QuickBooks won’t match if you are trying to tally the transactions older than 180 days.

- It could also appear when the dollar amount in QuickBooks differs from the amount cleared by your financial institution.

- You have recorded the transaction into the wrong bank account.

What Should You Do When Payroll Not Matching With Bank Transactions in QuickBooks?

Once you have gathered immense information about what causes the payroll not to match with bank transactions in the QuickBooks Online issue, let’s find out the quick fixes for the error. So, let’s get a better understanding of all the solutions described below and resume creating paychecks to pay the employees on time.

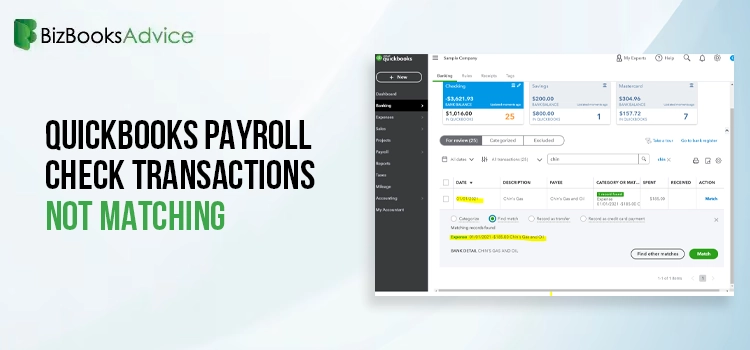

Solution First: Spot the Discrepancies Between the Transactions By Matching Them.

- Firstly, move to the bank feed and pick the transaction in question from the list of options to proceed ahead.

- After this, browse to the Find Match option and select the checkbox next to the transaction that you wish to tally. Alternatively, you can apply the Filter to streamline the list of entries, making it easier to pick the appropriate transaction.

- Proceeding further, you must move to the Resolve feature and complete the fields accurately. Later on, it is necessary to input the amount difference that you may discover into the “Amount Field”.

- Finally, you must go with the Save option after making the necessary changes to the transactions.

Read also: Importing Credit Card Transactions into QuickBooks: Tips and Tricks

Solution Second: Modify the Amount Mentioned On the Paper Check

Sometimes, adding the wrong amount on the paper check might give rise to the QuickBooks payroll check transactions not matching issue. Therefore, to resolve the issue, it is necessary to make changes to the amount listed on the paycheck, which helps you tally the amount with the one listed on the bank feed.

Steps to Edit Amount in QuickBooks Online Payroll

- Initially, move to the Payroll section, and from the expanded list of options, choose the Employees option.

- Afterward, head to the Paycheck List and then pick the paychecks that you wish to edit, and then go with the Edit option.

- Thereon, hit the Yes tab to complete the changes made.

Instructions For Editing a Paycheck in QuickBooks Desktop Payroll

- Begin by browsing the Banking menu and moving to the Use Register option.

- Afterward, you must pick the bank account you wish to edit and go with the OK tab.

- Thereon, you must choose and then launch the check in question to proceed.

- Next, move to the Paycheck Detail and then start updating the paychecks as per your preference.

- Now, when you are done making the necessary changes, click the OK tab.

- Finally, you simply need to pick Save & Close, followed by the Yes option.

Solution Third: Exclude the Downloaded Bank Transaction & Clear the Check in Check Register

- In the first place, move to the Gear icon and browse to the Charts of Accounts.

- You must start searching for the account and then go with the View Register option.

- Now, what you need to do is simply start locating the transaction and select it to open the expanded menu.

- Next, you must place a tick mark beside the check column and then hit the box unless the letter C is shown on the screen.

- After making the necessary changes, go to the Save tab and check whether the issue still exists.

Read More: QuickBooks Missing Name List: Troubleshooting Tips

Solution Fourth: Verify the Name Listed in the Charts of Accounts to the One Mentioned in Payroll Settings

For matching the transactions listed in the charts of accounts to the ones listed in the Payroll settings of QuickBooks you need to perform the step-by-step instructions outlined below.

- Start the process by moving to the Gear icon and then click the Payroll Settings option.

- After this, switch to the Accounting section and start searching for the correct bank account to be utilized.

- Subsequently, hit the Save and then the Close tab to apply the changes successfully.

- Now, you must access the Payroll section and launch the details of paycheques that you are having difficulty matching.

- At last, roll back to the Charts of Accounts and start looking for the account that you can spot in the previous step.

- Later on, what you must do is merge both of these accounts.

- Ultimately, when you are done merging the accounts in QuickBooks Online, roll back to the Bank feed option and you will notice that the paycheque will start matching the entry.

Here’s How to match payroll checks in QuickBooks Online Smoothly

The payroll accounts are the accounts that affect how you record payroll expenses in the journal entries. Moreover, this page will guide you regarding how to add and tally those journal entries to your bank account transactions.

Stepwise Instructions to Add Expenses Transactions in Online Banking

Below, we have stated the proper procedure to add expense transactions in Online Banking.

Step 1: Start Matching the Payments Done For the Payroll

- Initially, navigate to the Transactions menu from the left panel and then pick the Bank Transaction option.

- After this, you need to go with the bank account that you require to pay your employees and pick the transaction to proceed further.

- Next, click the Transaction Type drop-down menu arrow to choose the Expense option.

- Moving ahead, start looking for the payroll account and then pick an appropriate tax code by clicking the drop-down menu list.

- Now that you have made the necessary changes, go with the Confirm option and it will generate a transaction to debit the balance in the bank account. Later on, you need to credit the Payroll clearing account.

- Ultimately, you must perform the procedure once again when you discover numerous line items from the bank consisting of the original pay run amount for the amounts paid.

Step 2: Cross-Verifying Your Payments

Now that you have successfully listed the payments, you must verify that the Payroll Clearing account shows the balance as zero. However, to check the payment, you need to implement the steps illustrated below.

- In the beginning, you must browse to the Settings icon and then go to the Charts of Accounts.

- After that, start locating the account name and opt for the Account History option.

- You can also mention the super payments as the Expense, but the account must be chosen in the Superannuation Payables section.

- Now that you have added the payments accurately, you will discover that the Superannuation Payables account must show zero balance. To do so, you should perform the same steps mentioned above.

Instructions To Match the Journal Transactions In Online Banking

If you are accessing the ABA files to pay your employees, then all you can do is edit the default bank payment account to your bank account rather than clearing the bank account.

- In the initial stage, navigate to the Payroll section, and from there, go to the Payroll Settings.

- Afterward, you must switch to the Charts of Accounts section, which you get right beneath the Business Settings section.

- When you are done, browse the Default Accounts option and try running the regular payroll.

- Next, when you reach the Transactions screen, you can easily tally the journal entry with that to the payment made.

Know More About How to Record Salary Payments in QuickBooks Online

If you want a detailed procedure for recording salary payments in QuickBooks Online, read the steps below.

- Initially, it would help if you hit the + New option at the upper left corner of the screen and then click the Journal Entry option.

- Now, look beneath the Date section for the paycheque date and click Debit and Credit accounts.

- Soon after this, you must choose the Make Recurring option and list the memorable Template Name. Later, you must ensure that the Template Type is set to Unscheduled and then go with the Save Template option.

- Finally, when you finish the above steps, navigate to the Save button to apply the changes securely.

Summarizing the Above!!

QuickBooks Payroll Check Transactions Not Matching is the most complex issue, but it can easily be resolved by applying the solutions ahead in the post. However, if you still need additional help, immediately connect with our QB experts at +1-866-408-0444 for quick resolution